Adani Wilmar Share Price Target 2024, 2025, 2027, 2030, 2040

If you think about which share will be best for investment in recent times then you should know about Adani Wilmar Share Price Target. Today in our blog we will explain the basic idea about the Adani Wilmar Share Price Target 2024, 2025, 2027, 2030, 2040. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

Adani Wilmar Share Price Target is a trading share in the share market. In this article, we will discuss the company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price yearly. We use expert data and analysis to understand the Adani Wilmar Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s look at the Adani Wilmar Share Price Target 2024 to 2040.

What Is Adani Wilmar Limited (AWL) Company?

Adani Wilmar Limited (AWL) is an Indian multinational food and beverage company that was established in the year 1999. The headquarters of the company is situated in Ahmedabad. Adani Wilmar Limited was a joint venture between Adani Enterprises and Wilmar International.

Overview Of Adani Wilmar Limited Company

Adani Wilmar is one of India’s largest processors of Palm oil. The company exported its products to the Middle East, Southeast Asia, and Africa. Adani Wilmar company’s total number of manufacturing plants is 22 and distributed in 10 different states. Adani Wilmar brand is normally a brand for foods and edible oils but after the year 2014, the company launched other products like rice, soy chunks, and flour. In the year 2019, the company entered into personal care products under the brand Alife.

| Company Name | Adani Wilmar Limited |

| Market Cap | ₹42,725.75 Crore |

| Book Value | ₹64.25 |

| Face Value | ₹1 |

| 52 Week High | ₹423.01 |

| 52 Week Low | ₹285.85 |

| P/B | 5.12 |

| DIV. YIELD | 0% |

Financial Data Analysis Of Adani Wilmar Limited

We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. Adani Wilmar Limited Share Price Target also depended upon the ratio described below.

| PE Ratio | Return On Assets (ROA) | Current Ratio | Return On Equity (ROE) |

| 112 | 0.76% | 1.24 | 3.42% |

History Of Adani Wilmar Share Price Target From 2024 to 2040

Adani Wilmar Share is a bullish trend in the share market. Adani Wilmar Share is under both the Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The last 1 month’s share growth was -10.90 (-3.24%), the last 1 year’s share growth was decreased to -72.80 (-18.27%). Adani Wilmar Share growth hit a lower circuit in the last 1 year but in the last 1 month, the amount began to increase.

Adani Wilmar Share Price return amount was -18.4 % in the last 1 year but in the last 1 month’s share return amount started to increase to -5.37%. Adani Wilmar Share will grow more in the coming future. If anyone wants to invest in the share it will be profitable on a long-term basis. Let’s have a look at Adani Wilmar Share Price Target From 2024 to 2040.

Also Read – Hindustan Unilever Share Price Target

Adani Wilmar Share Price Target 2024

The most demanding product of Adani Wilmar Company is Edible Oil, the company manufactures different types of edible oil products like Soyabean Oil, Rice bran oil, Mustard Oil, Groundnut Oil, Sunflower Oil, Vanaspati, and different types, especially facts. The company’s edible oils are under some flagship brands like Fortune, Aadhar, Golden Chef, Fryola, Bullet, etc.

| Year | Adani Wilmar Share Price Target 2024 |

| 1st Price Target | 330.47 |

| 2nd Price Target | 445.89 |

The total revenue of Adani Wilmar Company was ₹55,625.74 Crore in March 2023 which decreased to ₹49,625.78 Crore in March 2024. The net revenue amount from the operation was ₹56,147.85 Crore in March 2023 it also decreased to ₹49.456.26 Crore in March 2024. If we look at Adani Wilmar Share Price Target forecast for 2024, the 1st Price Target is ₹330.47 and the 2nd Price Target is ₹445.89.

Adani Wilmar Share Price Target 2025

Adani Wilmar Company also supplies some special types of Fats like lauric fats which are used as substitutes for milk fat, another one is cocoa butter which is used as a substitute for ice cream, for baked products the company supplies industrial margarine and vanaspati to cafes, restaurants. The food segments offer different types of food products like Suji, Maida, Basan, Pulses Sugar, etc.

| Year | Adani Wilmar Share Price Target 2025 |

| 1st Price Target | 450.12 |

| 2nd Price Target | 525.74 |

The Profit growth of the company is not so good. The last 3 year’s profit growth declined to -24.85%. The net profit amount of the company was ₹607.23 Crore in March 2023 which decreased to ₹280.74 Crore in March 2024. The operating profit amount of the company was ₹915.85 Crore in March 2023 which increased to ₹1,185.74 Crore in March 2024. If we look at Adani Wilmar Share Price Target forecast for 2025, the 1st Price Target is ₹450.12 and the 2nd Price Target is ₹525.74.

Adani Wilmar Share Price Target 2027

From the Food and FMCG segment, the company’s revenue amount was ₹4,123 Crore in the year 2023. The most popular key products are Wheat Flour and Rice which crossed the limitation of ₹1,000 Crore in the year 2023. The rice segments of the company offer Basmati and non-Basmati rice variants. Adani Wilmar Limited is the second-largest player among India’s famous brands. In the financial year 2023, from the edible oils, the company’s revenue amount was ₹45,000 Crore.

| Year | Adani Wilmar Share Price Target 2027 |

| 1st Price Target | 750.23 |

| 2nd Price Target | 878.76 |

The sales percentage of the company is not also very good. The last 5 year’s sales percentage was 11.85% which decreased to 9.95% in the last 3 years. The net sales amount was ₹12,450.85 Crore in December 2023 which increased to ₹12,785.45 Crore in March 2024. If we look at Adani Wilmar Share Price Target forecast for 2027, the 1st Price Target is ₹750.23 and the 2nd Price Target is ₹878.76.

Also Read – Nestle India Share Price Target

Adani Wilmar Share Price Target 2030

Adani Wilmar Company offers Sugar from the year 2021 under the brand Kohinoor brand. The company also offers different types of pulses including Masoor, Rajma, Desi Masoor, Sona Moong, Dal, etc. Some products are Fortune Soya Chunkies, Kohinoor Biryani Kit, Fortune Poha, etc. Adani Wilmar company also introduced its Castor Oil Plant in the year 2008. The company exported its products to different 50 countries.

| Year | Adani Wilmar Share Price Target 2030 |

| 1st Price Target | 1,374.85 |

| 2nd Price Target | 1,456.56 |

As the company is a very old company and has a good market value the promoter holding capacity of the company is good which is 87.85% which means many good investor wants to invest in the share. The ROE percentage of the company was 13.45% in the last 5 years which decreased to 8.12% in the last 3 years and in the last 1 year it became 3.41%. If we look at Adani Wilmar Share Price Target forecast for 2030, the 1st Price Target is ₹1,374.85 and the 2nd Price Target is ₹1,456.56.

Adani Wilmar Share Price Target 2040

Adani Wilmar Company gives a big outlook to the Advertisement Segment, through the advertisement Segment in mass media like television, billboards, and digital Social Media for more expansion of its products range. The company has more than 10,000 distributors and has 600,000 retail outlets. The EBITDA amount was ₹1,852 Crore in the year 2022 which decreased to ₹1,745 Crore in the year 2023. The Asset Turn Over Ratio was ₹11.1 Crore in the year 2022 which increased to ₹11.9 Crore in the year 2023.

| Year | Adani Wilmar Share Price Target 2040 |

| 1st Price Target | 2,556.78 |

| 2nd Price Target | 2,645.52 |

The ROCE percentage of the company was 19.12% in the last 5 years which decreased to 15.36% in the last 3 years and in the last 1 year, the percentage became 10.26%. The total expenditure amount was ₹11,999.56 Crore In December 2023 which increased to ₹12,450.74 Crore in March 2024. If we look at Adani Wilmar Share Price Target forecast for 2030, the 1st Price Target is ₹2,556.78 and the 2nd Price Target is ₹2,645.52.

Peer’s Company of Adani Wilmar Limited

- ADF Foods

- Ambo Agritec

- Amit Corp

- Anjani Foods

- Anik Industries

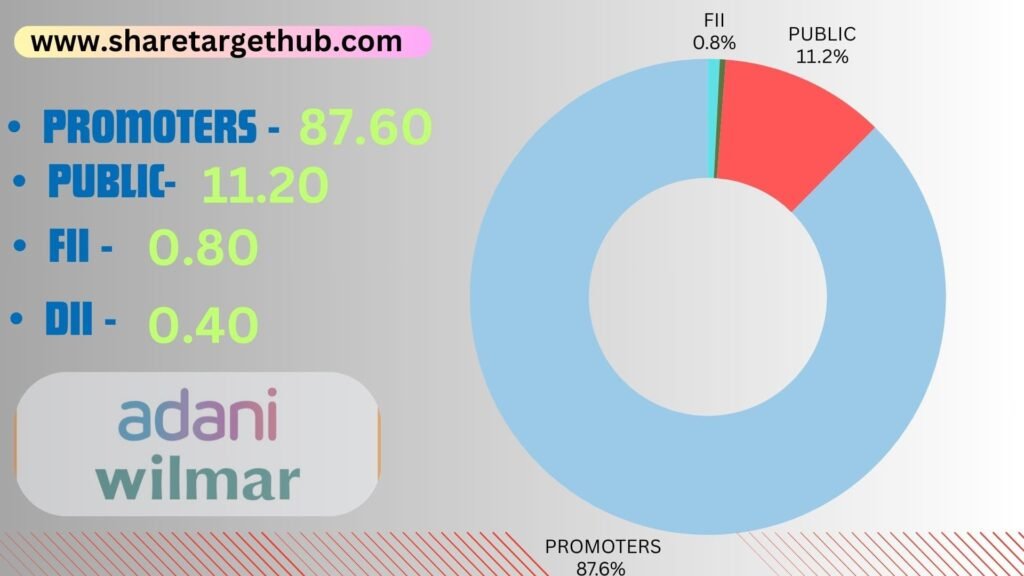

Investors Types And Ratio Of Adani Wilmar Limited

There are mainly Four main Types of Investors in Adani Wilmar Limited. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (owner of the company) through overall capital. Adani Wilmar Limited Company’s promoter holding capacity is 87.60%.

Public Holding

Public Investors are individuals who invest in the public market profit in the future (large and small companies). Adani Wilmar Limited Company’s public holding capacity is 11.20%.

FII

Foreign Institutional Investors are those big companies that invest in different countries company. Adani Wilmar Limited Company’s FII is 0.80%.

DII

Domestic Institutional Investors (like Insurance, companies, and mutual funds) who invest in their own country. Adani Wilmar Limited Company’s DII is 0.40%.

Advantages and Disadvantages Of Adani Wilmar Share

Every share has some advantages and some disadvantages also. So, the Adani Wilmar Share Price Target also has some advantages and disadvantages described below.

Advantages

- The company has an efficient cash conversation cycle which is 48.12 days.

- The cash flow management of the company is good, PAT stands for 1.33.

- The promoter holding capacity of the company is high which is 87.60%.

- The company is increasing with zero promoter pledges.

- Book Value amount also increasing in the last 2 years every year.

Disadvantages

- The company has a high PE ratio which is 161.23.

- The company has a poor profit growth which is -24.85% in the last 3 years.

- The sales growth percentage of the company is not so high which is 9.95% in the last 3 years.

- The company has a high EBITDA which is 31.25.

Also Read – ITC Share Price Target

FAQ

Who Is the CEO of Adani Wilmar Company?

Mr. Angshu Mallick is the CEO of Adani Wilmar Company.

What is the main function of Adani Wilmar Company?

Adani Wilmar is one of India’s largest producers of Crude Palm Oil, Edible Oils, and many other food products. The company was established in the year 1999 and it was a joint venture between Adani Enterprises and Wilmar International.

What is the future forecast of Adani Wilmar Company?

Adani Wilmar is a very old company the promotor holding capacity of the company is 87.60%. The company always maintains good product value and products are manufactured under many good brand names. The company spread its business in different countries it will grow more in the coming future.

What is the Adani Wilmar Share Price Target for 2024?

Adani Wilmar Share Price Traget for 2024 is ₹330.47 to ₹445.89.

What is the Adani Wilmar Share Price Target for 2025?

Adani Wilmar Share Price Traget for 2025 is ₹450.12 to ₹525.74.

What is the Adani Wilmar Share Price Target for 2027?

Adani Wilmar Share Price Traget for 2027 is ₹750.23 to ₹878.76.

What is the Adani Wilmar Share Price Target for 2028?

Adani Wilmar Share Price Traget for 2028 is ₹910.47 to ₹1,050.85.

What is the Adani Wilmar Share Price Target for 2030?

Adani Wilmar Share Price Traget for 2030 is ₹1,374.85 to ₹1,456.56.

What is the Adani Wilmar Share Price Target for 2040?

Adani Wilmar Share Price Traget for 2040 is ₹2,556.78 to ₹2,645.52.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the Adani Wilmar Share Price Target. By doing the research and taking advice from the experts we ensure that on a long-term basis, Adani Wilmar Share Price Target may reach a very high position. Adani Wilmar is mainly related to the Food & FMCG Sector. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.